|

Exceeding $20 Billion, The NPD Group Reports

U.S. toy sales grew by 5 percent in 2016, reaching $20.4 billion, according to retail sales data* from global information company The NPD Group. The industry was 16 percent larger in 2016 than 2013, which calculates to a compounded annual growth rate of 5 percent.

“The toy industry is continuing on the strong and steady path of success it has paved for itself over the last few years. Innovation is coming to consumers in many forms, and the question of ‘where should we go next?’ is as crucial as ever for toy manufacturers and retailers,” said Juli Lennett, senior vice president and U.S. toys industry analyst, The NPD Group.

Growth Drivers

|

|

Collectibles** was a top contributor to the industry’s 2016 growth, with sales growing 33 percent, or $432 million, to reach $1.8 billion and representing 9 percent of total toy industry dollars. Heading into the holiday season, NPD predicted that blind packs would be especially popular gift items and, indeed, the momentum gained during the first three quarters of the year continued through Q4. Sales of blind packs grew 60 percent for the year, and since 2013 sales have grown more than six-fold.

The next largest contributor was Outdoor & Sports Toys, the largest supercategory which also experienced the largest dollar gains of any supercategory, at $328 million. Leading this growth were sports and summer seasonal toys.

Next, the Games segment grew 21 percent for the year, or $307 million, with games for children as well as adults all showing growth. Illustrating the influence of this segment, Pie Face Showdown and Speak Out both landed in the top-10 list of new items for 2016.

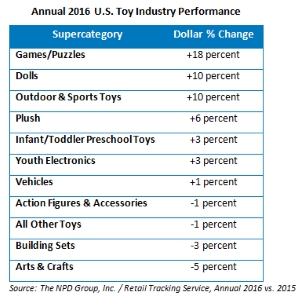

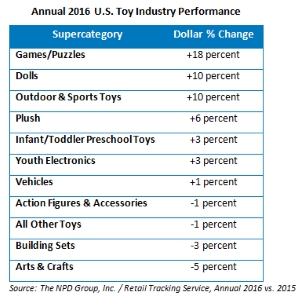

Games/Puzzles, Dolls, and Outdoor & Sports Toys were among seven out of the 11 super-categories that posted gains in 2016, and were the fastest-growing at 18 percent, 10 percent, and 10 percent, respectively.

There were also a number of properties that helped grow the toy industry in 2016. Star Wars outperformed its 2015 sales, reaching nearly $760 million in 2016 and maintaining its position as the top property, based on dollar sales. Coinciding with the Pokémon GO phenomenon and Pokémon Moon and Pokémon Sun video games, Pokémon was the top growth property of the year in toys. Further illustrating the impact of content on toy sales, three of the 10 top-growing properties had movie tie-ins from movies released in 2016: Trolls, Batman v Superman, and Finding Dory. |

Holiday Impact

Consumers had two extra shopping days between Thanksgiving and Christmas in 2016, with one of those being a Saturday; however, overall retail performance was mixed this holiday season. While sales the week before Christmas grew by 28 percent, it is likely this happened at the expense of the other weeks in Q4. Consumers began the holiday shopping season by taking advantage of early Cyber Monday online promotions during Thanksgiving/Black Friday week, but sales took a downward turn during the first three weeks of December, until last-minute shopping kicked in.

“The toy industry has become the poster child for a successful industry, but as always there is still plenty of work to be done,” said Lennett. “Holiday 2016 taught us that extra shopping days and earlier online promotions don’t necessarily translate to more overall sales. Retailers need to increase shopping visits earlier in the holiday season and improve overall sales volumes across all channels. The online channel continues to grow at the expense of brick-and-mortar, and the toy industry needs to address how to make up for the volumes tied to in-store impulse purchases – an important sales generator. Retailers and manufacturers who get creative in their strategies will win in 2017.”

*Source: The NPD Group Inc. / Retail Tracking Service, January-December 2016

Data is representative of retailers that participate in The NPD Group's Retail Tracking Service. NPD’s current estimate is that the Retail Tracking Service represents approximately 80 percent of the U.S. retail market for Toys. Projected to 100 percent of the market, the U.S. toy industry is estimated at about $26 billion.

**Collectibles include Non-Strategic Trade Cards/Collectible Stickers, Strategic Trading Card Games, Mini Figures & Scene Sets, Action Figure Collectibles & Accessories, Playset Dolls & Collectibles, Blind Packs as well as assorted brands that are collectible.

The U.S. is one of 12 global toy markets tracked by NPD. The other countries include Australia, Belgium, Brazil, Canada, France, Germany, Italy, Mexico, Russia, Spain, and UK. |